How will my donation help?

All projects of ATMA Foundation are based on the felt needs of vulnerable groups and underserved communities.

Your contribution will directly impact their lives. It will definitely help bring a smile!

Why Donate to ATMA?

- Tax benefits to donor u/s 80 G

- FCRA registered organization

- Credible & compliant organization

- Transparent financial system

- Less than 5% administrative expenses

- Every rupee goes to beneficiary

- Efforts of our volunteers add value to your donation

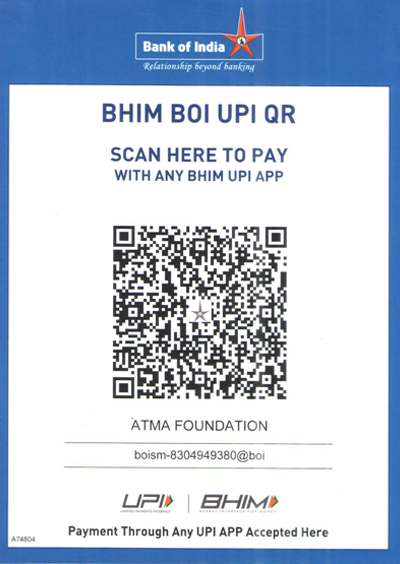

Ways To Help

For Indian Citizens

For Foreign Citizens

Please share your email id and we shall share our FCRA account details.

Frequently Asked Questions

Yes, ATMA Foundation has annual audits and files IT returns

No! We value the privacy of every donor and will not cede or sell your data for any purpose. Your data will be used only for our accounting purposes and for sharing with the Government agencies as per compliance requirements.

You may contact us via mail at info@atmafoundation.org or by phone at +91-9400995232

ATMA Foundation receives funding support from the Government of India and from the Government of Kerala for certain specific projects. However, this constitutes less than 10% of our total funding needs.

All projects of ATMA Foundation are based on the felt needs of the underserved and underprivileged communities. Over the years, we have impacted millions of lives. But we could never have done this without YOU. Every drop in the ocean counts. Your contribution will directly impact the life of a beneficiary - it could be a helpless child, a needy woman, an aged patient, an uneducated villager - or anyone who needs care and support. But it will definitely help bring a smile!

Yes - all donations to ATMA Foundation are 50% exempt from tax under section 80G of the Income Tax Act. This tax exemption is valid only in India. However, we do run some fundraising campaigns in association with crowdfunding platforms like Give. Contributions through these platforms have US and UK tax benefits too

Yes. An ATMA Foundation receipt will be sent to you by email, within three days of receiving your contribution. Please make sure that you mention your full address, PAN number and email id in the donor details form. Or, if you have done a direct transfer, please share your payment details to us in the email id - info@atmafoundation.org.

We will send you a receipt from ATMA Foundation by email as soon as we receive your contribution. This can be temporarily used for tax purposes. According to the new rules, we are required to upload your details on the Income Tax Portal in the prescribed format at the end of the financial year. You will receive a receipt (Form 10 BE) by email. You may need to submit this receipt to claim tax exemption.